Building Wealth & Investing

Private equity investments

Welcome to Finance and Fury. Looking at alternative to listed shares, with private equity. Globally, private equity has for many years been a niche area of the investment universe, dominated by institutional investors and very wealthy individuals. However, trends in...

Predicting future market returns using the Buffett indicator

Welcome to Finance and Fury. The returns for shares over the last few years has not been good – especially in comparison to other assets – Is it still worth it to invest in shares? Afterall, the Australian Share index is sitting almost the same point as 18 months ago,...

Arguments for and against a housing crash

Welcome to Finance and Fury. Arguments for and against a housing crash – in this episode, we will look at both sides of this and see what could happen Is the property market going to see a decline – beyond what has already occurred? Or is it on the path to recovery....

Finance & Economics

Debt ceilings and defaults

Welcome to Finance and Fury. Debt ceilings, at the moment there are many media pundits warning about the US defaulting on their debt and the fallout that would follow, being a complete economic meltdown. We are going to do a deeper dive into this in today’s episode....

Regulations and the war on drugs

Welcome to Finance and Fury. Do regulations solve any problems? To explore this concept, we will be looking specifically at drug regulations – because if the answer was yes, regulations would solve the problems of society and have the intended outcome of creating a...

A case for abolishing Central Banks

Welcome to Finance and Fury. This episode is exploring the idea that abolishing central banks in their current form would be better for you and I. Now I am fully aware that CBs like the Fed and RBA won’t be abolished anytime soon, modern financial system is too deep...

Property

Arguments for and against a housing crash

Welcome to Finance and Fury. Arguments for and against a housing crash – in this episode, we will look at both sides of this and see what could happen Is the property market going to see a decline – beyond what has already occurred? Or is it on the path to recovery....

Blackstone, liquidity and investment risks

Welcome to Finance and Fury. We will look at Investment liquidity and how this relates to risk to markets and investors – liquidity issues are starting to become an increasing risk factor for many investments as interest rates are on the rise With rising...

Bridges to nowhere – China’s debt problems

Welcome to Finance and Fury. In this episode we are going to look at the debt problems that China has – at the moment, economic news globally is going from bad to worse, with talks of recessions, high inflation, declining financial markets – but with all of this...

Shares

Private equity investments

Welcome to Finance and Fury. Looking at alternative to listed shares, with private equity. Globally, private equity has for many years been a niche area of the investment universe, dominated by institutional investors and very wealthy individuals. However, trends in...

Predicting future market returns using the Buffett indicator

Welcome to Finance and Fury. The returns for shares over the last few years has not been good – especially in comparison to other assets – Is it still worth it to invest in shares? Afterall, the Australian Share index is sitting almost the same point as 18 months ago,...

Managed Funds or Exchange Traded Funds (ETF)?

Welcome to Finance and Fury. ETFs vs managed funds – Same same but different – when to use In many ways, managed funds and exchange traded funds (ETFs) are the same. They are both investment vehicles that allow investors to pool their funds with other investors...

Superannuation & Retirement

End of the financial year checklist

Welcome to Finance and Fury. Sorry for no episodes, EOFY always a busy time, so haven’t had a chance to prep much or find time to record. Excuses` out of the way and in the spirt of the end of the financial year – as it is almost here – I wanted to do a bit of a...

What are the best ways to save for a home deposit?

Welcome to Finance and Fury – For this week’s episode we are answering a question from listener David – surrounding some options to save for a home deposit “The conventional wisdom is to save for, say, a home deposit in a bank account with as high as possible interest...

The Federal Budget: How will you be affected and will the proposals benefit you?

Welcome to Finance and Fury. This episode we’ll be talking about latest federal budget that was announced this week - and the implications this will have for individual There were many announcements in the budget – few good things like the reduced tax on innovated...

Politics, Psychology and your money

Investing around geopolitical risks

Welcome to Finance and Fury. In this episode we will be looking at geopolitical risks and equity portfolios. Geopolitical risks are nothing new – these are always going on and equity markets are always looking at geopolitical risks – and how it will impact the price...

Frogs and taxes

Welcome to Finance and Fury. Question: Would you be comfortable paying an individual carbon tax? Most people may say yes, depending on how much. In this episode we look at the history of taxes and look what I believe is a new type of tax that we will face, being a...

Can a Central Bank go bankrupt and collapse the economy?

Welcome to Finance and Fury. Today we explore whether a Central Bank can go bankrupt and collapse the economy? In the modern state of the economy, if fiat money fails due to central banking errors, what does this mean for the global financial system and central banks?...

The bane of economic growth

Welcome to Finance and Fury. Everyone is talking about bad economic conditions at the moment and bear markets – but what is the cause? Slowing economic growth and a lack of recovery, higher inflation has many different causes that have piled up over the years – but at...

Affordable rental policies and unintended consequences

Welcome to Finance and Fury. Today’s episode is going to be going through some economic theory on some recent promises from politicians on housing policy – the focus on most of these has been on rental markets – for affordable rent – there’s lots of coverage on...

The economic impact from the Russia-Ukraine conflict on financial markets

Welcome to Finance and Fury. I hope you are all doing well and safe at the moment – I know a lot of people in QLD and NSW have lost their homes and my thoughts go out to you - where we live is currently cut off – we are fortunate though – no flooding in the house –...

Tax

End of the financial year checklist

Welcome to Finance and Fury. Sorry for no episodes, EOFY always a busy time, so haven’t had a chance to prep much or find time to record. Excuses` out of the way and in the spirt of the end of the financial year – as it is almost here – I wanted to do a bit of a...

Frogs and taxes

Welcome to Finance and Fury. Question: Would you be comfortable paying an individual carbon tax? Most people may say yes, depending on how much. In this episode we look at the history of taxes and look what I believe is a new type of tax that we will face, being a...

The Federal Budget: How will you be affected and will the proposals benefit you?

Welcome to Finance and Fury. This episode we’ll be talking about latest federal budget that was announced this week - and the implications this will have for individual There were many announcements in the budget – few good things like the reduced tax on innovated...

Debt and Cash Flow

What are the proposed changes to the responsible lending laws and what this means for Australian borrowers and the economy at large.

Welcome to Finance and Fury, the Furious Friday edition. In this episode – we will be going through the potential changes to the current Responsible lending laws that may occur next year – as these laws will either be watered down or completely removed - As it...

Is it better to rent or buy a property in the current economic environment?

Welcome to Finance and Fury, the Say What Wednesday edition. This week the Question is from Emma. “Hi Louis – Would like to get your opinion on if it is a good time to buy a property to live in or if it is better to continue renting? We have saved up for enough of a...

How to use the recent tax cuts as an opportunity to build additional wealth!

Welcome to Finance and Fury You might have seen the budget that came out last week – in this episode we will be looking at the bringing forward of the tax cut – but also using this as an opportunity and what to do with it The budget and the tax cuts – The Government...

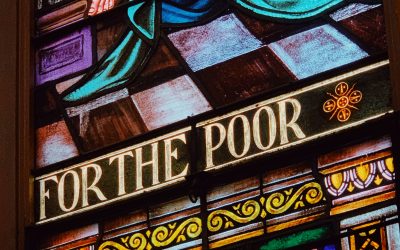

Welfare & Social Security

Incentives, economic inequality and poverty

Welcome to Finance and Fury. Last week’s episode laid the ground work for how incentives work in relation to economic decision making – this week we will be looking at one aspect to expand on this topic – that is how our incentives to help others can be used against...

The importance of economic incentives, problems and economics

Welcome to Finance and Fury. A few weeks ago we did an episode on the Manifesto of Equals – got me thinking more about the nature of humans and how we respond to incentives – and how this can be really good for us, or be highjacked at our detriment – this is all food...

End of the financial year checklist

Welcome to Finance and Fury. Sorry for no episodes, EOFY always a busy time, so haven’t had a chance to prep much or find time to record. Excuses` out of the way and in the spirt of the end of the financial year – as it is almost here – I wanted to do a bit of a...

Technology & New Ideas

Investing in megatrends for long term capital growth

Welcome to Finance and Fury. This episode we are going to have a look at investing in megatrends. When investing – there are many different approaches people can take – people have different return requirements – hence, when constructing a portfolio of investments,...

Central Bank Digital Currencies – coming to a wallet near you.

Welcome to Finance and Fury. This episode is to look at Central bank digital currencies - Central banks releasing digital currencies is an inevitability at this stage - proof-of-concept programmes are currently in the works across the globe - with more than 80% of...

Banks and cryptoassets – the first introduction of a regulatory framework.

Welcome to Finance and Fury. This episode we will continue looking at the crypto markets. In particular, we focus on the regulatory frameworks that have been released by the Bank for international settlements, BIS for short. One division of the BIS - the Basel...

The Intro Eps

(Intro Series) The wrap up party

Intro - Episode 6 The wrap up party Hey guys! Welcome to the wrap up party for this little intro series Well done if you’ve made it to this point listening. I know a lot of it could have come across pretty confusing …and don’t worry I was quite confused myself by this...

(Intro Series) What does your retirement look like, and why?

Intro - Episode 5 What does your retirement look like, and why? What do you normally think about before you go anywhere? Anyone who has ever left the house before has probably had to think about something before taking a step out the front door. Anyone who hasn’t,...

(Intro Series) Trusting yourself and learning the basics

Intro - Episode 4 Trusting yourself and learning the basics To start off, do you think that having a map to financial independence would be the ideal solution? Compared to a puzzle it actually would be far better than trying to piece together something, if you could...