Property

Arguments for and against a housing crash

Welcome to Finance and Fury. Arguments for and against a housing crash – in this episode, we will look at both sides of this and see what could happen Is the property market going to see a decline – beyond what has already occurred? Or is it on the path to recovery....

read moreBlackstone, liquidity and investment risks

Welcome to Finance and Fury. We will look at Investment liquidity and how this relates to risk to markets and investors – liquidity issues are starting to become an increasing risk factor for many investments as interest rates are on the rise With rising...

read moreBridges to nowhere – China’s debt problems

Welcome to Finance and Fury. In this episode we are going to look at the debt problems that China has – at the moment, economic news globally is going from bad to worse, with talks of recessions, high inflation, declining financial markets – but with all of this...

read moreAll else being equal, what influences property prices more than anything else?

Welcome to Finance and Fury. In this episode we look at the most important factor that moves property prices. In other words, what one thing affects property prices more than anything both positively or negatively. This doesn’t mean that it is the only thing that...

read moreAffordable rental policies and unintended consequences

Welcome to Finance and Fury. Today’s episode is going to be going through some economic theory on some recent promises from politicians on housing policy – the focus on most of these has been on rental markets – for affordable rent – there’s lots of coverage on...

read moreThe future state of the housing market.

Welcome to Finance and Fury. Current state of the housing market – and the influence The RBA has and will have on Housing prices. The RBA has a long history of influencing the Australian housing market due to their control over the cash rate – for the past 30+ years –...

read moreLearn Finance Online Personal Finance Course

It has never been easier to be financially wealthy, but at the same time, it has become incredibly complicated. The game has changed, but we can show you how to play.

Search all episodes by category

Most Recent posts

Sunk costs and the Commonwealth Games

Welcome to Finance and Fury. Many of you would have seen the news over the last few weeks about Victoria cancelling the commonwealth games plans due to financial constraints. Is this the right decision when viewed through an economic lens – looking at the concept of a...

Private equity investments

Welcome to Finance and Fury. Looking at alternative to listed shares, with private equity. Globally, private equity has for many years been a niche area of the investment universe, dominated by institutional investors and very wealthy individuals. However, trends in...

Predicting future market returns using the Buffett indicator

Welcome to Finance and Fury. The returns for shares over the last few years has not been good – especially in comparison to other assets – Is it still worth it to invest in shares? Afterall, the Australian Share index is sitting almost the same point as 18 months ago,...

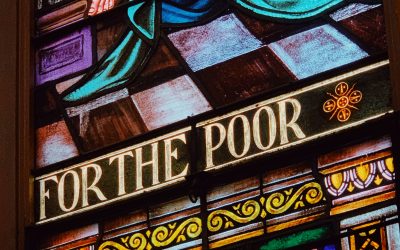

Incentives, economic inequality and poverty

Welcome to Finance and Fury. Last week’s episode laid the ground work for how incentives work in relation to economic decision making – this week we will be looking at one aspect to expand on this topic – that is how our incentives to help others can be used against...

The importance of economic incentives, problems and economics

Welcome to Finance and Fury. A few weeks ago we did an episode on the Manifesto of Equals – got me thinking more about the nature of humans and how we respond to incentives – and how this can be really good for us, or be highjacked at our detriment – this is all food...

End of the financial year checklist

Welcome to Finance and Fury. Sorry for no episodes, EOFY always a busy time, so haven’t had a chance to prep much or find time to record. Excuses` out of the way and in the spirt of the end of the financial year – as it is almost here – I wanted to do a bit of a...