Business

How does corporate debt fuel market bubbles?

Welcome to Finance and Fury, The Furious Friday Edition Today – want to look at how much Corporate debt has been fuelling the top end of the share markets growth – signs that if liquidity is withdrawn, companies and markets collapse Last FF ep – went through...

read moreWhat does Central Bank issued cryptocurrency look like?

Welcome to Finance and Fury, the Furious Friday Edition Welcome to FF FF – Hasn’t been a FF in a while – but last was running through Crypto markets in relation to the BIS and powers that be Today – Want to cover the potential of what central banks using crypto and by...

read moreThe Government’s war on cash and personal freedom continues with the introduction of the Currency (Restrictions) Bill 2019!

Welcome to Finance and Fury In today's episode, I thought it was important to cover Currency Bill - Might have seen in the news – headlines about the $10k transaction – Currency (Restrictions on the Use of Cash) Bill 2019 – what we are talking about – had first round...

read moreHow do you identify a scam, before ASIC or the regulators do it for you?

Welcome to Finance and Fury, The say What Wednesday edition where we answer your questions, and sometimes questions from people from the gym – such as today Is this a scam – moneysmart have a page on this – which is good resource – give a quick summary of this – but...

read moreNailing Business Cashflow Forecasts, whether you’re established, looking to expand, you’re a start up or a business in trouble

Hi Guys and welcome to Finance and Fury’s ‘Say What Wednesday’ Episode. Today we’re joined again by Nick. Our question today comes from Justin who asks, “Our building company recently went through issues with its cashflow, so as directors we halved our wages to help…I...

read moreLearn Finance Online Personal Finance Course

It has never been easier to be financially wealthy, but at the same time, it has become incredibly complicated. The game has changed, but we can show you how to play.

Search all episodes by category

Most Recent posts

Sunk costs and the Commonwealth Games

Welcome to Finance and Fury. Many of you would have seen the news over the last few weeks about Victoria cancelling the commonwealth games plans due to financial constraints. Is this the right decision when viewed through an economic lens – looking at the concept of a...

Private equity investments

Welcome to Finance and Fury. Looking at alternative to listed shares, with private equity. Globally, private equity has for many years been a niche area of the investment universe, dominated by institutional investors and very wealthy individuals. However, trends in...

Predicting future market returns using the Buffett indicator

Welcome to Finance and Fury. The returns for shares over the last few years has not been good – especially in comparison to other assets – Is it still worth it to invest in shares? Afterall, the Australian Share index is sitting almost the same point as 18 months ago,...

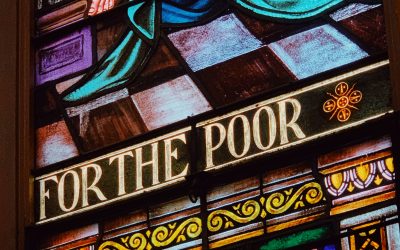

Incentives, economic inequality and poverty

Welcome to Finance and Fury. Last week’s episode laid the ground work for how incentives work in relation to economic decision making – this week we will be looking at one aspect to expand on this topic – that is how our incentives to help others can be used against...

The importance of economic incentives, problems and economics

Welcome to Finance and Fury. A few weeks ago we did an episode on the Manifesto of Equals – got me thinking more about the nature of humans and how we respond to incentives – and how this can be really good for us, or be highjacked at our detriment – this is all food...

End of the financial year checklist

Welcome to Finance and Fury. Sorry for no episodes, EOFY always a busy time, so haven’t had a chance to prep much or find time to record. Excuses` out of the way and in the spirt of the end of the financial year – as it is almost here – I wanted to do a bit of a...