Furious Friday

Is minimum wage such a good thing after all?

Welcome to Finance and Fury! The main aim of our Furious Friday editions is to clear up misconceptions. We’ve been seeing a lot of news stories lately about companies underpaying staff – 7-Eleven, hospitality businesses, celebrity chefs etc.

The incidence of this has risen over the past few years – why can’t these people just pay the legal wage?

This episode may be a bit upsetting depending on what side of the coin you’re looking at…we’re talking about wage controls, that is, Minimum Wages. Are they good or bad?

What are minimum wage laws?

Regulation/body of law which prohibits employers from hiring employees for less than a given wage

Australian History

- Basic Wage since 1907, which wasn’t quite as strict as what it is now. More of a prescription, or suggestion, rather than enforced legislation.

- 14 December 2005, the Australian Fair Pay Commissionwas established

- The Australian Fair Pay Commission was replaced by Fair Work Australiain 2010, and since then there’s been a significant rise in the minimum wage level.

- Base rates

- October 2007 – $13.74 per hour

- 1 July 2018 – $18.93 per hour

- Casual rates get an additional 25% loading

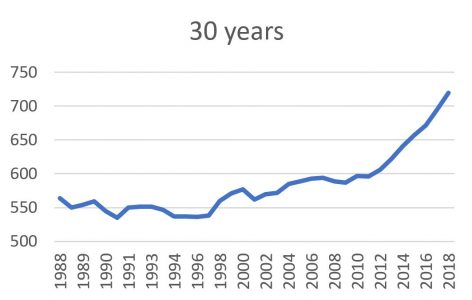

- GRAPH: Wages normalised to 2018 value

Wages normalised to 2018

So, is this good or bad? – There’s always two sides to every coin

- The minimum wage law does not create any new jobs.

- Prohibits employment relationships that offer wages within a certain prescribed range (low paying jobs, for instance) – sounds awful to say but some jobs are worth $18.93 per hour

- This prohibits employers and employees deciding between them as to what the pay rate should be

- Employment is mobile – people in high demand are headhunted for higher wages

- Commentators argued – contrary to prevailing economic theory, minimum wages increase overall employment

- Money in pockets of workers flowing to greater spending in economy

- Greater demand for goods and services, therefore there should be more employment to meet this demand….

- But what about supply? That may have the opposite effect, as labour costs go up

- Less potential labour used

- And/or, as costs go up, so do prices

Let’s unpack this by looking at the two sides; Employees (those who are getting paid), and Employers (those who are doing the paying)

Employees – The effects: What happens when minimum wages are introduced

- For existing employees

- The employer decides to either raise wages, or to terminate the employment

- It’s easier to raise the wage, as it is actually quite costly to terminate in Australia

- So, it’s good for existing employees

- What about Future employees

- Creates productivity bar (employers need to make sure that employees are worth it)

- This is an issue for two groups of employees – Young market entries, lower skilled positions who are priced out of a lot of roles in the economy.

The productivity bar: You need to get what you pay for

The prerequisites for employment increases – how is this measured? By a piece of paper, known as a Degree.

But when everyone has something, it becomes less valuable – this is the same with education and means a devaluation of education in the long term.

- Higher wages increase need for competition in your skills (or perceived skills)

- Not everyone can be employed – if an employer has $60,000 for wages the want to make sure they get the most qualified person that amount.

- Need to get a degree for what used to be an entry level position without one

- 2011 to 2016 saw massive jump in education levels

- Grad Diplomas (28%)

- Bachelor degrees (24%)

- Biggest increase is in post grad degrees (46%) – It seems bachelor degrees are now the new high school diplomas

- But if there is no employment that matches your degree – you feel like doing something else is beneath you

- My example: Studied for 5.5 years – being naive, I thought this put me above the curve. After searching around, I came to realise that I was still entry level. So, I started on $50,000 – working about 60-70 hours a week – $14.88 per hour

- Some other examples, like some of my friends: Grads in Law and Audit – $40-50k as well and working similar hours

- This is where those who are young, without degrees, will struggle to find work.

- Skipping back 20-30 years ago these entry level positions didn’t require you to have a degree.

What the stats say – Employment levels

Lot of studies find that minimum wages are statistically insignificant regarding their effect on employment overall – that is, they don’t create much of a change.

This is true when you look at it in aggregate. As we just touched on, it’s hard to fire existing employees when minimum wages go up. But…

- The employment rate only factors in those who are looking for work

- Those who can’t get a job in the existing job market and so stop looking for one, are no longer are counted as unemployed

- Underemployment – Those who are employed, but can’t get enough work – are still counted as employed

- Employers cut their hours

- Unemployment rate around 5.4% – Includes those actively looking for work

- Underutilisation rate includes underemployment – 13.7%

- Including unemployment = 20%

- For example: US Gas crisis – price control/ceiling on petrol – almost the same amount of gas was sold, but the number of hours that service stations were open decreased, from around 100 hours per week to 20 hours.

Employers – Factors

- Costs (Labour)

- Break even costs – Some jobs aren’t profitable to employ people in now

- Higher wages – costs go up for production of goods, which gets passed onto consumers and negates the overall rise in wages. How? Price increase in what we buy!

- Industries, like manufacturing, then go offshore (drop of 24% in manufacturing jobs over 2011 to 2016)

- Index points, as far as labour costs go, steadily increased from 45 in 1988 to 100 in 2010

- Since 2010 it has been flat – Labour costs have normalised – Forced to pay salary – so not much voluntary increase since then

- But the costs still go up – People from overseas think Australia is expensive, and it is!

- Show me a country with high wages and low costs of living and I’ll be very surprised. The two are very closely related.

- Productivity and the ways that businesses actually operate

- The switch to “capital intensive” over “labour intensive” goods. Hence, the drop-in manufacturing

- There is a lot of the talk is about how technology is replacing human capital – which happens when it costs too much. Minimum wages speed up the process.

Summary:

Overall, the jury is out on the effects of minimum wages – however there is consensus for the young or lower skilled:

- Thomas Sowell – argues that this policy hurts those who it is designed to help the most – lower entry workers

- Evidence shows that the overall unemployment level is often unaffected, people employed in low-skill and low-paying positions experience greater adverse effects

- OECD study also said the results of its research suggested that a rise in the minimum wage had a negative effect on teenage employment.

- Many European economies introducing or increasing the minimum wage have experienced increased unemployment in low-skill, low-pay positions

- Andrew Leigh – historical employment data on increases in the minimum wage in WA, relative to employment in the rest of Australia.

- found that increases in the minimum wage in WA were followed by reductions in employment

- most pronounced among young people, where the minimum wage had a large effect on labour demand.

- The results of this research found a consistent negative relationship between the minimum wage and labour demand (i.e., when the former is increased, the latter decreases).

- Add to the cost of living increasing – These policies sound nice in theory but…

- No-one wants to see people struggling.

- But imagine that the Government forced a wage for one role of $1M compared to $25,000 previously

- That is 40 less people employed, but costs are still going up for the production/employment

- A lot of younger Australians spend 3 or 4 years to get a degree, get out of uni with $40k in debt, just to get into the workforce. In this way there may be some additional harm being done

Thanks for listening!