Welcome to Finance and Fury

The election has been set for the 18th of May

The marketing has been coming in and it has been pretty forward with the smear campaigns

It seems like a lot of it preys off people not understanding how the economy works, and there is nothing wrong with this as it is a complicated topic. But its abhorrent that its used to win votes, without providing policy on how a party will run things.

Today

- See through the political messaging used

- The messages used

- The tactics used

An election promise is not a policy

- There are 2 sides to every policy

Those who would give up essential Liberty, to purchase a little temporary Safety, deserve neither Liberty nor Safety

- Under governmental policy, it is a trade off

- Liberty is the state of being free within society from oppressive restrictions imposed by authority on one’s way of life, behaviour, or political views

- Safety is a state where you are not in danger or risk

- We have a relative safety measure, economic, terrorism, climate change etc.

- You need to give up liberty. For example, climate change = additional taxes, restrictions on choice of power

- What were the TSA introduced for?

- DHS found a 95% failure rate in detecting weapons or explosives in their undercover operations

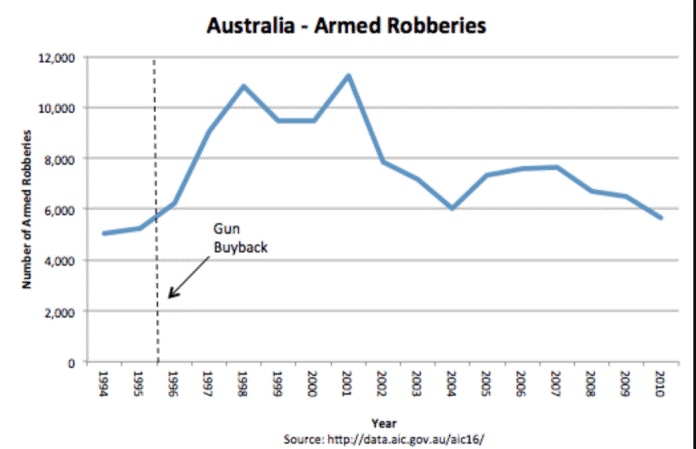

- In Australia, we had the Gun buyback laws in 1996 after the massacre at Port Author

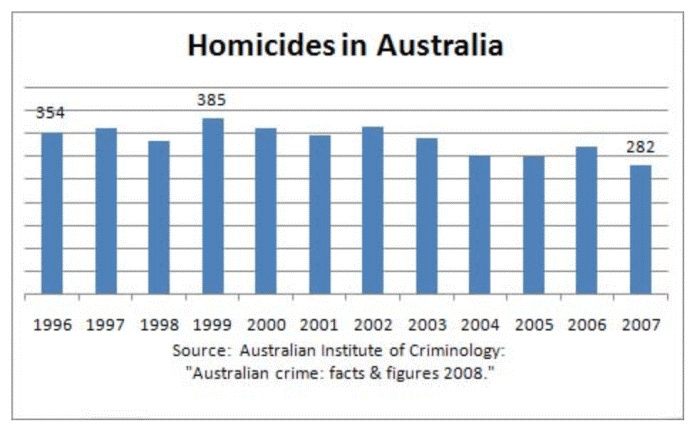

- There was already a downward trend in gun-related deaths before these laws

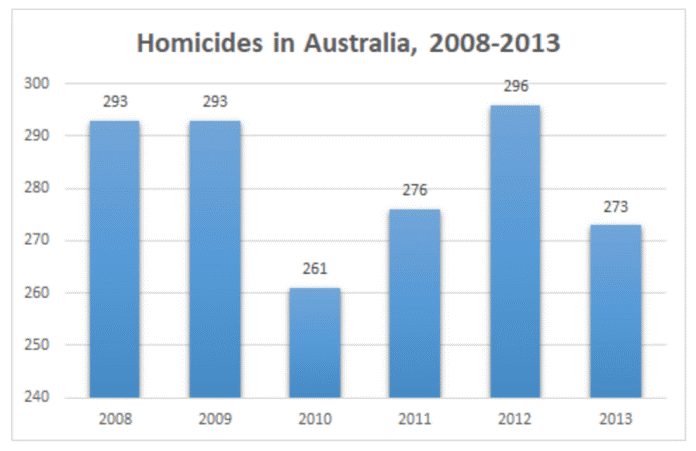

- But what about deaths overall, were they decreased?

- Is society becoming less violent overall?

- What isn’t mentioned is armed robberies increasing

- Policies don’t seem to be needed

- Is there a political message here to make you just feel unsafe?

- Fearing something evokes a stronger emotional emotion than gaining something. Called loss aversion

- The political message gets you to operate out of fear

Each side of politics has a starting point:

- On the left side – the starting point is that things are unfair and a vote for us gets a solution to the problem

- On the right side – the starting point is that things are good and not to give it up, a vote for us avoids a problem

- So what has changed? Our perception of how good we have it?

- What do you want in life? What about your neighbour? What about some random 3 blocks away?

- Why do you want to increase freedoms? What does it do for the country?

- Mao’s great leap forward and the enemy within

- If you think that you are doomed to begin with, would you ever even try bothering?

- Can the problems in Australia really be solved with 1 vote?

- How is our health care?

- The message of a fair go?

- Democracy is two wolves voting to eat the sheep

- A lot of this caters to envy and greed another power emotion next to fear

Summary:

- A major issue for politics today

- Not a win for the country, but a win for the party

- Watch out for any government policies that rely on you giving up your liberty for promises of more

- How they will make it easier for my efforts to work?

- It is better for you to choose your own path

Thank you for listening. If you want to get in contact you can do so here.

Graphs: